Will GPS Tracking Reduce My Insurance Premiums?

Published on Sept 22nd, 2023Yes. GPS tracking reduces fleet insurance premiums. So, why do insurance companies ask you to pay less for the same coverage when you install company vehicle tracking devices? Well, they know the risk of a payout is reduced with a GPS tracker.

How Your Insurance Company Calculates Your Fleet Premiums

Commercial vehicle insurance premiums are calculated using a complex series of factors. The calculation varies some between insurance providers, so you should always shop around for the best rates and coverage.

Fleet insurance companies use these factors to determine your premiums:

Ownership – If you lease or rent fleet vehicles, there are additional risks that could impact your premiums.

Location – Vehicles primarily driven in large urban centers pay more than if you drive outside the city. Plus, secured storage locations for vehicles not in use lowers premiums.

Driving habits – A track record of hiring safe drivers lowers fleet premiums. Fewer claims in the past give you a lower premium in the future.

Vehicle types – The make and model of fleet vehicles significantly impact the premiums. Vehicles with higher safety ratings have lower premiums. Also, vehicles highly likely to be vandalized or stolen see higher premiums. The value of the vehicle plays a role, too.

Anti-theft devices – A theft-deterrent or vehicle alarm helps insurance providers know you are working to deter vandals and thieves.

How GPS Tracking Reduces Insurance Premiums

Fleet vehicles often qualify for discounts of 25% to 35% or more on vehicle insurance when the company installs a GPS tracking system. Your insurance company knows that these GPS tracker features mitigate the risk you will make a claim.

Improved Driver Behavior on the Road

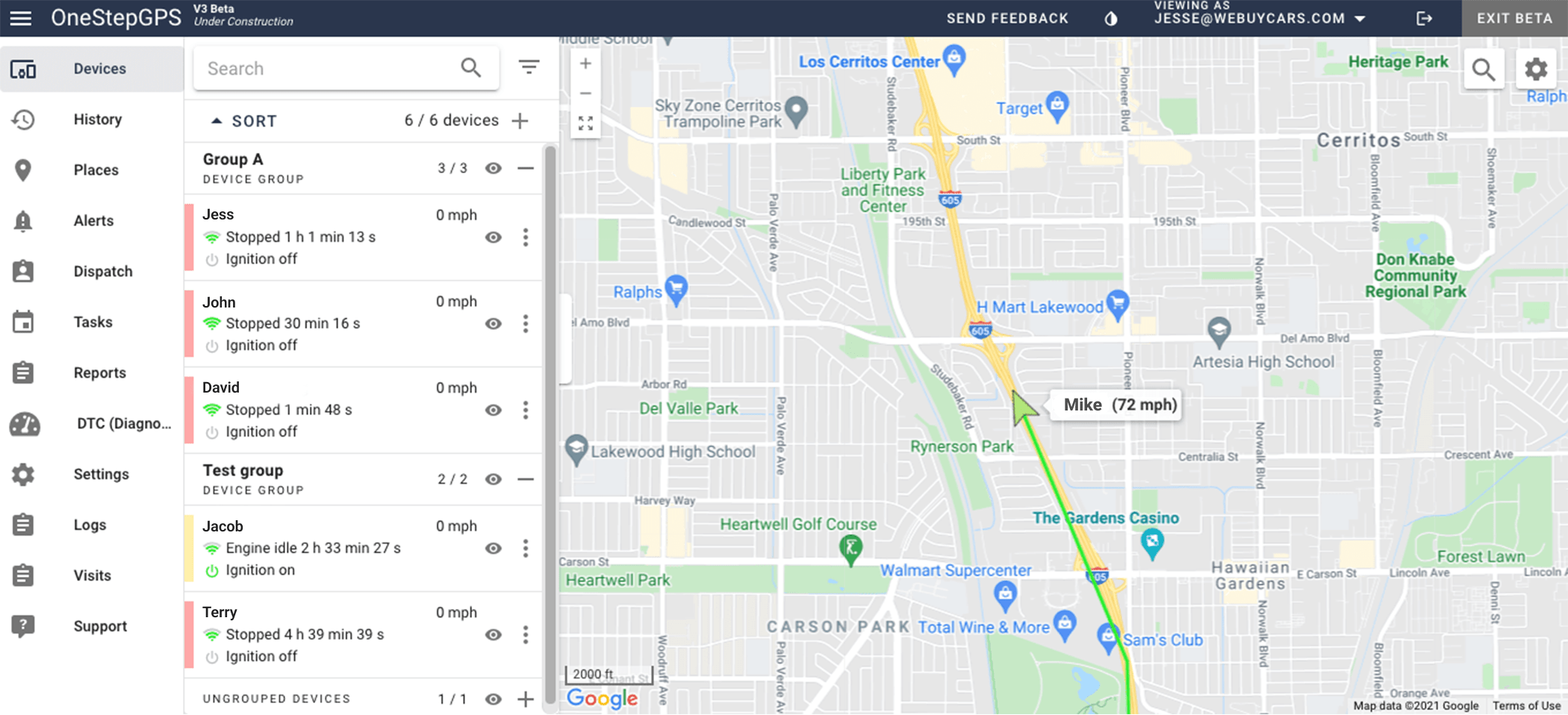

A significant percentage of drivers regularly break the speed limit. But a GPS tracking device detects speeding, harsh cornering, excessive acceleration, and sudden braking. Knowing that management receives a notification alert encourages your drivers to adopt safer habits on the road, leading to fewer accidents and lower insurance costs.

GPS tracking helps lower accident risks in commercial fleets by promoting improved driver behavior with real-time visibility. Fleet managers identify and address unsafe driving before it leads to accidents.

Plus, GPS tracking impacts fleet insurance by reducing the severity and number of accidents. Insurance companies consider driver behavior and fleet safety practices to determine premiums, so businesses with safer driving records are eligible for discounted premiums.

The American Trucking Association reports that cars cause over 80% of car-truck crashes, even though truck drivers may unjustly receive blame. With technology-based evidence to clear truck companies of wrongdoing, insurers mitigate payouts.

Proactive Vehicle Maintenance Increases Road Safety

GPS trackers are essential for the successful management of modern fleets. Using advanced telematics technology creates proactive maintenance schedules customized to each vehicle. Maintenance schedules consider the exact usage of each fleet vehicle, so the records are more accurate than a set-interval maintenance plan.

Proactive vehicle maintenance reduces the likelihood of breakdowns and accidents, leading to improved road safety. Many fleets find proactive maintenance reduces vehicle breakdowns by up to 90%, and maintenance costs are up to 14% lower. Add that to the lower insurance premiums when your provider considers vehicle maintenance and safety practices, and a fleet management tracking system becomes a natural choice.

Not every issue can be managed proactively. So, you also receive alerts about any mechanical malfunction.

Reduced Vandalism and Theft

Fleet GPS tracking also creates disturbance alerts. You are instantly notified if a fleet vehicle is broken into or bumped. Alert the authorities immediately to recover assets quickly and reduce the chances of expensive repairs, replacements, or an insurance claim. If a vehicle with a GPS tracker is stolen, you and law enforcement can pinpoint the exact location with real-time data.

Insurers use historical GPS tracker data for detailed information to verify ownership and track the stolen vehicle, reducing fraudulent claims and ultimately reducing premiums.

Prevent Fleet Vehicle Misuse

GPS trackers are an effective tool in preventing commercial vehicle misuse, like drivers running personal errands and other driving during off-hours. Insurers appreciate the value of monitoring vehicles to prevent misuse, resulting in lower insurance costs for your business.

The Information Your Insurer Requires For A GPS Tracking Discount On Your Fleet Premiums

When you install your fleet management tracking system, contact your insurance company representative. Let them know when the installation is complete. The insurance company will require some specific details to make sure your company qualifies for the premium discount.

Most fleet owners must provide the following information to the insurance company to qualify:

- The Vehicle Identification Numbers (VIN) and make/model of each fleet vehicle being tracked.

- Type of GPS tracking device installed. Be ready to provide paperwork from the installer.

- Details about additional vehicle safety features.

- Outline of any voluntary usage reporting you will provide. Check with your installer to see which reports you could offer.

- Security measures such as an alarm system or how the GPS tracker works as an anti-theft device.

Your insurer may request additional information to apply a discount to reward you for taking the proactive measure of installing a GPS tracking system.

Conclusion

Fleet GPS tracking is a valuable tool for reducing your vehicle insurance premiums. Using company vehicle tracking devices decreases the risk of theft and vandalism, improves driver behavior, prevents vehicle misuse and promotes proactive maintenance. All of these benefits lower accident risks and reduce claim costs, which is what your insurer needs to reduce your premiums.

(888) 919-7536

(888) 919-7536

Fleet Tracking

Fleet Tracking Trucking and ELD

Trucking and ELD Asset Tracking

Asset Tracking Battery Tracking

Battery Tracking

Chat with us

Chat with us